Why Terry Smith & Fundsmith Bought Manhattan Associates

Terry Smith, founder of Fundsmith, is one of the leading figures in “Quality Investing.” I use quotes because no investor claims they want to buy low-quality businesses with competitive disadvantages in declining industries. But if I had to define “Quality Investing” in one sentence, it would be this quote by Terry Smith:

Buy good companies. Don’t overpay. Do nothing.

Fundsmith recently added Manhattan Associates (MANH) to its portfolio.

So what makes Manhattan Associates a good company? And did Fundsmith pay a good price?

Lucky for us, Terry has written two books, done countless interviews, and published an Owner’s Manual that outlines how they identify good companies at fair prices.

Using these sources, I’ll create a checklist to evaluate Manhattan Associates.

Quality of the Business

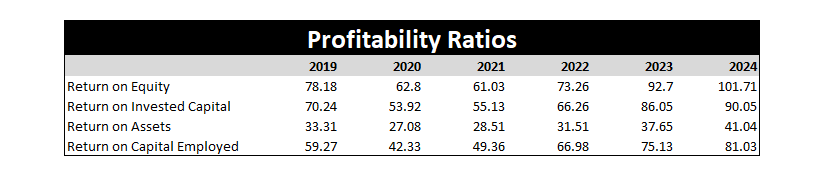

High Return on Operating Capital Employed (ROCE)?

A good company is one which creates value for its shareholders by making a high return on capital – significantly above its cost of capital – across the business and economic cycle.

In their Owner’s Manual, Fundsmith uses the metric Returns on Capital Employed (ROCE) to measure a company’s returns on capital instead of ROIC.

ROCE = EBIT/(Total Assets - Current Liabilities)

or

ROCE = EBIT/(Equity + Long-term Debt)

Intangible, Hard to Replicate Assets?

Intangible assets are non-physical assets that are extremely difficult to copy or compete against, such as brands, patents, distribution networks, entrenched client relationships, and installed base.

These intangibles create switching costs, high barriers to entry, network effects, and scale advantages that allow a quality company to outcompete its peers and resist the mean reversion in returns on capital.

Manhattan Associates (MANH) is a SaaS company and the clear leader in warehouse management systems software. It helps users manage their supply chains, inventory, and omnichannel operations, which is an extremely complex process.

This makes it a Central Nervous System Software.

Manhattan’s software is so important to the daily operations of its users that losing it or changing it could be highly disruptive and potentially jeopardize the entire business. This is an incredible intangible asset that leads to extremely high switching costs once Manhattan Associates is integrated with the business.

Resilience & Low Obsolescence Risk?

Fundsmith avoids industries subject to rapid technological innovation where products become obsolete quickly.

Manhattan is a tech company, and the tech sector faces constant disruption. However, its high switching costs protect it from competition. A competitor cannot simply build a 10% better or cheaper product and convince Manhattan customers to switch. Changing such a vital software solution could jeopardize the entire business.

From a jobs-to-be-done perspective, Manhattan’s software already solves supply chain management problems for its customers. Unless the product becomes inadequate or prohibitively expensive, there is little risk that a new competitor will win business away from Manhattan.

Like all SaaS companies, Manhattan continuously improves its product to meet current and future client needs.

Organic Growth with High Reinvestment Returns?

Manhattan has made only four acquisitions over the past 20 years, indicating that most of its growth has been organic.

Looking ahead, the company has two major growth catalysts. First, it continues converting legacy on-premise software users to its cloud-based SaaS offering. This initiative began in 2017-2018, and full conversion is taking longer than initially anticipated. The company must wait until customers are ready, and the transition process is lengthy due to the mission-critical nature of Manhattan’s supply chain software. Neither Manhattan nor its customers can afford mistakes during this process.

Based on cloud revenue and the percentage of service revenue from cloud services, approximately 75-80% of legacy customers have been converted, leaving 20-25% still to transition. This ongoing conversion provides near-term growth in recurring revenue with high profit margins while strengthening Manhattan’s future pricing power.

Second, Manhattan continues adding new customers driven by increased omnichannel demand from retailers.

Investment in the SaaS/Cloud platform expands Manhattan’s recurring revenue base. Combined with high profit margins and strong free cash flow conversion, these investments generate excellent returns.

Manhattan’s recent returns on incremental invested capital demonstrate this success: 209.2% over three years and 86.1% over five years. These figures show that reinvestment has paid off handsomely.

High Leverage?

Fundsmith actively avoids companies that need leverage to earn acceptable returns, such as banks, credit card lenders, leasing companies, and real estate businesses. They also want to avoid companies that are over-indebted.

This is partially covered by using Return on Capital Employed over Return on Equity. A high debt load can increase ROE without a fundamental improvement in the operations of the business.

Debt increases the fragility of a company. Terry Smith is looking for businesses that can survive and thrive through any economic environment. High debt increases fixed financial costs and could reduce management’s ability to make good long-term value-creating decisions when faced with meeting short-term debt payments.

Debt also erodes free cash flow available to shareholders that can be used to buy back shares, pay or increase their dividend, or, most importantly, reinvest in other high-returning opportunities that will increase shareholder value over the long term.

Manhattan’s current Debt to Equity Ratio is 0.16x, and its current FCF/Debt ratio is 6x. Debt is low on an absolute basis and well covered by their free cash flow.

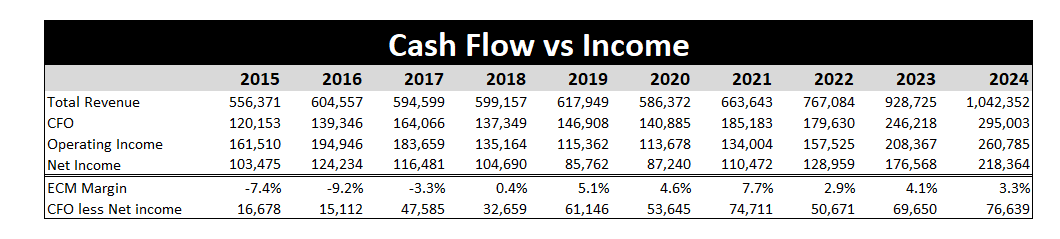

High Cash Conversion?

Does Manhattan’s free cash flow closely track reported earnings? A large divergence between cash flows and reported earnings could indicate accounting tricks designed to hide fundamental weaknesses in the underlying business.

One way to assess this is to subtract Net Income from Cash from Operations. We would expect cash flow to exceed net income, but not by much. This analysis shows that cash flow and net income track each other closely.

Another approach is to use the Excess Cash Margin (ECM) from the book Creative Cash Flow Reporting by Charles Mulford & Eugene Comiskey.

ECM takes Cash from Operations, subtracts Operating Income, and divides that number by Total Revenue.

You want a small positive number because a healthy business will have low or stable excess cash margins. Operating profits and cash flow should move together.

Persistently high or rising excess cash margins could indicate that the company is using unsustainable accounting gimmicks to inflate earnings or hide deterioration in the business.

Manhattan’s ECM is very low but not stable. To increase accuracy, you would need to adjust cash flow to remove non-recurring items. For the sake of time, I did not do that, so it is possible that adjusting for non-recurring items could make Manhattan’s ECM more stable.

Based on a cursory look, Manhattan Associates appears to convert a high percentage of its net income into cash flow.

Valuation

Terry Smith and Fundsmith avoid complex discounted cash flow models. Instead, they prefer to evaluate a company’s current free cash flow yield relative to government bonds, its peers, and Fundsmith’s other portfolio holdings.

According to Whalewisdom, Fundsmith purchased Manhattan Associates in Q2 2025, potentially during the Liberation Day market sell-off. During this period, Manhattan’s FCF yield jumped to 3%, above its long-term mean of 2%.

At the time, the U.S. 10-Year yield was trading between 4.1% and 4.5%, give or take a few basis points.

Manhattan’s FCF yield was not cheap compared to bond yields. However, Fundsmith also considers growth potential. They are willing to accept a lower absolute FCF yield if the underlying company can grow its free cash flow.

Over the past five years, Manhattan Associates has grown its FCF at a CAGR of 16.8%.

Looking forward, Manhattan is expected to grow revenues at 8% or more as it continues shifting to a SaaS-dominated product, which should also increase margins and drive higher free cash flow growth. The company is also benefiting from the secular trend of increased omnichannel presence for retailers, which should drive greater adoption of its software solutions.

With a starting FCF yield of 3% and minimum growth of 8%, the minimum expected total return is 11%, meeting Fundsmith’s “double-digit nominal return” hurdle rate.

If Manhattan grows faster than 8% and its free cash flow growth accelerates accordingly, Fundsmith’s potential returns increase substantially.

Why did Terry Smith & Fundsmith buy Manhattan Associates?

Because it met all their investment criteria.

Yes, they could’ve waited and tried to pay a cheaper price for Manhattan, but they still bought the company at a decent price, given its potential growth and its high switching costs as a central nervous system software that should lead to above-average shareholder returns.

Great post!!! Extremely high-quality research. Thanks.