7 Central Nervous System Software Companies

Why These Software Companies Are Nearly Impossible to Replace

Software is the central nervous system of modern business operations. Once installed, it becomes essential to the customer's daily operations and nearly impossible to remove.

Robert Smith, Vista Equity Partners

Central Nervous System software is the ultimate switching cost designation.

The software is so important to the daily functions of a business that without it, the business would die. And if it came down to it, management would rather pay the software bill than the interest on their debt.

"You realize a company will not pay the interest payment on their first lien until after they pay their software maintenance or subscription fee. We get paid our money first. Who has the better credit? He can’t run his business without our software.

Robert Smith, Vista Equity

CNS software also benefits from imperfect substitution. Competition exists, but their offerings and functionality can not reach the same level as the dominant player. Switching to the competition may save you on costs, but the disruption to normal business operations is far too costly to justify the switch.

The best way to explain a Central Nervous System software is to go through a few examples, and I’ll use the checklist/outline below as a guide.

Key Investment Characteristics

Mission-critical functionality

How deeply embedded is the software in the businesses that use it?

How vital is it in the daily operations of the business?

Strong Customer Retention?

Indicates high utility and high value for customers’ needs.

High switching costs

Imperfect Substitution?

Competitors exist, but their functionality and services can not match the full offering of a CNS software company

Industry Standard?

Steep learning Curve Trap?

Data Trap?

Indirect Network Effects through third-party integrations?

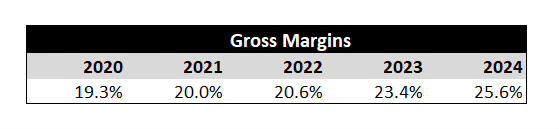

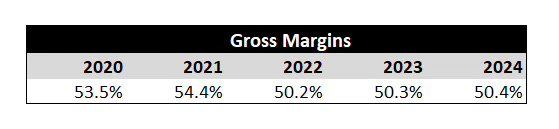

High and/or stable gross margins

High Gross Margins are a standard for SaaS companies

Stable gross margins demonstrate pricing power, which in turn reflects how essential the software is to customers.

Operating Leverage?

Growing profitability with growing scale?

Especially if it's a newer platform

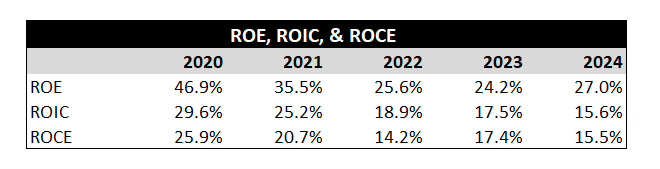

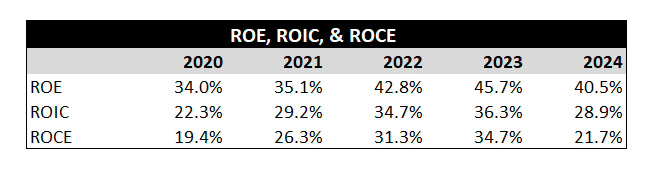

Growing ROE, ROIC, & ROCE Metrics?

Growing returns are another potential operating leverage indicator

CNS Software Companies

Intuit (QuickBooks Online)

Industry: Small Business Accounting

Mission-Critical Functionality

Poor accounting and cash flow management are the leading causes of small business failure. Even with an excellent product or service, businesses can't survive if they can't track cash flow, pay bills on time, or maintain capital for growth opportunities.

QuickBooks Online (QBO) serves as the foundational accounting system for small businesses, providing essential functions like invoicing, expense tracking, payroll, tax preparation, and financial reporting.

Competition, Customer Retention, & Switching Costs

With over 7 million small businesses using QuickBooks Online (QBO), it has established itself as the definitive accounting software for small businesses and their accountants. While alternatives like Xero and FreshBooks exist, they struggle to compete with Intuit's comprehensive feature set and extensive ecosystem of integrations. QBO has become synonymous with small business accounting, making it the default choice for companies seeking a professional accounting system.

Intuit's customer retention rate of 80%, rising to 84% for QBO Pro users, demonstrates strong customer loyalty despite small business market volatility. While these rates fall below the 90%+ benchmark typical for Central Nervous System software, context is crucial—20% of small businesses fail within their first year, and 50% fail within five years. This high failure rate naturally inflates customer churn.

QuickBooks creates powerful switching barriers through three key mechanisms.

First, the data trap: businesses accumulate years of vital financial records, transaction histories, and tax documentation that become increasingly valuable and difficult to migrate over time.

Second, the learning curve trap: staff members develop deep familiarity with QuickBooks' workflows and features, making any transition to alternative software highly disruptive to operations.

Finally, indirect network effects create additional switching costs through QuickBooks' extensive integration network, connecting seamlessly with banks, payment processors, and a vast ecosystem of third-party applications.

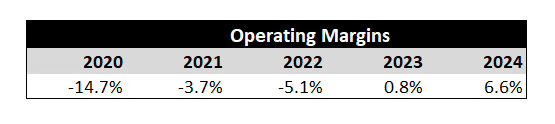

Pricing Power, Financial Performance, and Operating Leverage

Consistent gross margins are typically an indicator of pricing power, which demonstrates how essential a company's software is to its customers. Businesses accept price increases because the software provides crucial value to their operations.

Intuit consistently achieves gross margins above 80%, though these margins show some fluctuation.

These fluctuations stem from Intuit's consumer-facing product lines: TurboTax, Credit Karma, and Mailchimp (partially). Consumer businesses tend to experience more variability in their cost of goods.

As a mature company, Intuit demonstrates clear operating leverage through its high gross, operating, and net profit margins.

The company has also historically generated high returns on equity, invested capital, and assets.

These three metrics have declined recently after Intuit's acquisitions of Credit Karma and Mailchimp expanded its capital base.

Toast (TOST)

Industry: Restaurants

Mission-Critical Functionality

Toast's platform is deeply embedded in restaurant operations, serving as the primary interface for order management, payment processing, and kitchen operations. The software handles everything from taking orders, processing payments, managing inventory, integrating with third-party delivery apps, and analyzing sales data. Toast is the quintessential Central Nervous System Software.

Competition, Customer Retention, & Switching Costs

Toast demonstrates strong customer retention with a reported annual net revenue retention rate above 110%. This indicates that not only do restaurants stay with Toast, but they also increase their spending over time by adding more modules and services. Given the high failure rate of small restaurants, this retention rate is particularly impressive and highlights Toast's importance to small restaurant operators.

Toast has become the industry standard for small restaurants by focusing exclusively on this niche and delivering the best features and functionality for small restaurant operators. While competitors like Block (formerly Square), NCR, and Clover also serve restaurants, their broader focus on all small merchants means their offerings can't fully address restaurants' specific needs. These competitors lack Toast's comprehensive stack of restaurant-specific hardware, software, and payment solutions.

However, Toast isn't the industry standard for all restaurants—larger operations with 5+ locations or franchise chains typically require custom-built systems tailored to their specific business needs.

Beyond its position as the industry standard for small restaurants, Toast creates three powerful switching barriers.

First, the data trap: restaurants accumulate years of valuable operational data within Toast's system, including detailed sales records, customer preferences, and business intelligence. This data becomes increasingly difficult to migrate over time.

Second, the learning curve trap: restaurant staff become deeply familiar with Toast's interface and workflows. Switching systems would require extensive retraining of all teams, from servers to kitchen staff, causing significant operational disruptions.

Third, the hardware ecosystem lock-in: Toast's integrated hardware infrastructure, including kitchen display systems, card readers, and other equipment, creates physical dependencies that make switching both technically challenging and financially costly.

Pricing Power, Operating Leverage, and Financial Performance

Toast's 25% gross margins appear low for a SaaS company, but this reflects its three distinct business lines: hardware, software, and payments.

The company sells hardware at cost, using it as a loss leader to reduce barriers for restaurants joining the Toast platform.

The software segment generates the typical high-margin subscription revenue expected from SaaS offerings.

Toast combines its SaaS subscription and payment processing revenues under "Subscription Services and Financial Technology Solutions."

While payments drive most of Toast's revenue, it's a low-margin business. Toast retains a small percentage of each card transaction to cover chargebacks, refunds, and interchange fees. After settling funds and paying interchange fees, Toast's net take rate amounts to mere fractions of a percent, explaining the low overall gross margins.

As Toast scales, it's demonstrating operating leverage and improving net payment take rates. Recent quarters show better operating margins and progress toward profitability, even as the company continues significant growth investments.

Due to its business model, Toast won't achieve the high gross margins typical of pure SaaS companies like Intuit. However, its growing gross margins demonstrate both pricing power and the value Toasts provides to restaurants.

The company's improving ROE, ROIC, and ROA metrics demonstrate its growing operating leverage and validate its strong value proposition.

Cadence Design Systems

Industry: Semiconductor & Electronics Design

Mission-Critical Functionality

Cadence's EDA tools are fundamentally essential to the semiconductor industry; without them, modern chip design would be impossible. Their software enables engineers to create, verify, and test complex semiconductor designs that power today's electronic devices.

Competition, Customer Retention, & Switching Costs

Cadence's software is absolutely essential to the semiconductor industry, as demonstrated by its customer retention rate of almost 100%. This extraordinary level of customer loyalty stems from several factors that make switching EDA providers both expensive and risky.

First, chip design processes are intricately woven into EDA tools. Companies invest thousands of hours perfecting their workflows and establishing processes around these tools. Switching vendors could lead to severe productivity losses from disrupted workflows and potential loss of critical data during migration.

Second, engineering teams build deep expertise with specific EDA tools over years of use. A switch to alternative solutions would demand extensive retraining, causing significant productivity disruptions and delaying time-to-market for new products. In the semiconductor industry, where speed to market is paramount, such delays can severely impact competitiveness.

Third, the mission-critical nature of chip design means errors can be catastrophically expensive. Companies simply cannot risk design flaws that might arise from switching to less familiar tools. This risk aversion strongly favors established providers with proven track records.

These high switching costs and high barriers to entry create a stable oligopolistic market structure in EDA. Cadence and Synopsys each control about 36% of the market, while Siemens EDA holds around 20%. Though market shares fluctuate as Cadence and Synopsys compete and improve their offerings, the market remains stable. Semiconductor designers require the most advanced systems to ensure their chips are cutting-edge, often purchasing both Cadence and Synopsys systems to cross-verify chip designs. This dual-system approach reinforces the market's stability even amid strong competition.

Pricing Power, Operating Leverage, and Financial Performance

The oligopolistic market structure, combined with incredibly high switching costs, gives EDA tremendous pricing power now. And its highly stable gross margins confirm this.

But this wasn't always the case.

Prior to 2004, Cadence and other EDA software companies operated on a perpetual license model with annual maintenance fees. This business model created significant revenue volatility as customers could delay purchases during economic downturns, leading to unpredictable financial performance.

When Lip-Bu Tan became CEO of Cadence in 2009, he transformed the company by transitioning to a subscription-based revenue model. This shift provided more predictable revenue streams and better aligned the company's interests with its customers' success. The shift to a subscription model, plus other changes made by Lip-Bu Tan, transformed Cadence from a volatile software vendor into a stable, high-margin business with predictable recurring revenue.

The business shift also led to consistently high ROEs, ROICs, and ROAs.

Shopify

Industry: E-commerce & Retail

Mission-Critical Functionality

Shopify serves as the central nervous system for over 2 million merchants worldwide, providing essential e-commerce infrastructure that businesses depend on daily. The platform handles critical operations from inventory management and payment processing to shipping logistics and customer relationships.

Competition, Customer Retention, & Switching Costs

While Shopify faces competition from various e-commerce platforms, its comprehensive solution creates significant barriers for competitors. Traditional enterprise solutions like Adobe Commerce (formerly Magento) and Salesforce Commerce Cloud target larger businesses but lack Shopify's ease of use and extensive app ecosystem. Meanwhile, simpler solutions like Wix and Squarespace offer basic e-commerce functionality but can't match Shopify's scalability and advanced features.

BigCommerce, Shopify's closest direct competitor, serves a similar market but lacks Shopify's scale advantages in payment processing, fulfillment networks, and third-party integrations.

Besides its depth of services and scale advantages, Shopify also creates three large switching costs.

Shopify demonstrates strong retention characteristics through three key switching barriers:

First, the data trap: Merchants accumulate years of valuable business data within Shopify's ecosystem, including customer information, transaction histories, and inventory records. This data becomes increasingly difficult to migrate as time passes.

Second, the operational integration: Businesses build their entire workflows around Shopify's platform, from inventory management to customer service processes. Switching would require completely restructuring these essential business operations.

Third, the ecosystem lock-in: Merchants become deeply integrated with Shopify's vast network of apps, partners, and payment solutions. With over 6,000 apps in its marketplace, migrating to another platform would mean recreating these crucial integrations and relationships.

Pricing Power, Operating Leverage, &

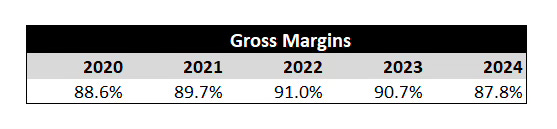

Shopify's pricing power is evident in its ability to maintain strong gross margins while continually expanding its service offerings.

Shopify’s overall Gross Margins are less than what we would expect with a pure SaaS company but Shopify has two different revenue streams: subscription solutions (with gross margins around 80%) and merchant solutions (with lower margins, ≈40% ).

Like Toast, Shopify handles payments for its customers, and its net take rate is a small fraction of the total money withheld per transaction. Again, most of it is paid out in interchange to the acquiring Bank, and Shopify retains a small portion for handling the transaction.

My initial concern for Shopify as a Central Nervous System Software is its low and fluctuating returns profile. This requires deeper analysis, as we expect a mission-critical software company with operating leverage to show consistently improving metrics.

Veeva Systems

Industry: Life Sciences

Mission-Critical Functionality

Veeva Systems stands as a cornerstone in the life sciences industry, providing cloud-based software solutions that manage critical processes throughout the entire pharmaceutical product lifecycle.

The platform handles essential regulatory compliance, clinical trials management, and quality control processes that are fundamental to drug development and commercialization. Veeva is necessary for pharmaceutical companies that want to efficiently manage their development pipelines.

Competition, Customer Retention, & Switching Costs

Similar to Toast, Veeva has focused exclusively on a single industry. While competitors exist, they lack Veeva's singular focus on life sciences. This specialization allows Veeva to provide the most comprehensive suite of solutions for the industry. The company has built a deep knowledge base of life sciences' specific needs, including regulatory requirements and specialized workflows, expertise that companies serving multiple industries cannot match.

As the first mover in cloud-based life sciences software, Veeva has built a substantial lead over generic providers. This early advantage enabled Veeva to establish trusted relationships with regulatory bodies and develop comprehensive knowledge of compliance requirements and validation processes. Any new competitor would need years to build similar industry expertise and regulatory credibility.

With revenue retention rates of around 115%, Veeva provides substantial value and creates high switching costs.

Veeva’s switching costs are also enhanced by the pharmaceutical industry's strict regulatory requirements and validation processes.

The pharmaceutical companies accumulate extensive audit trails and compliance documentation within Veeva's system. This historical data becomes a critical asset that would be extremely risky and complex to migrate.

Companies also invest heavily in staff training to use Veeva's platform. The specialized knowledge required for regulatory compliance and validation processes means retraining on a new system would be particularly disruptive.

Once Veeva becomes integrated into a company's drug development process, the operational costs of switching to another system are prohibitively high.

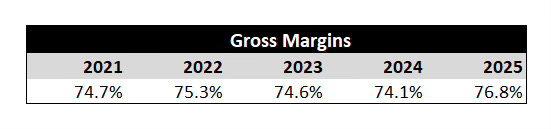

Financial Performance and Operating Leverage

The company maintains impressive gross margins above 70%, demonstrating strong pricing power.

Again, the concern is declining returns for such a mission-critical piece of software.

ROIC.ai, which uses a slightly different method of calculating ROIC than Alphasense, shows Veeva's ROIC declining from 12.94% to 10% for the missing years above.

The final two examples are recent IPOs targeting highly fragmented industries. Both companies are already becoming industry standards, with potential for strong growth as they capture more market share.

Keep reading with a 7-day free trial

Subscribe to Incremental Returns to keep reading this post and get 7 days of free access to the full post archives.