Beyond DCF: Two Other Ways to Value High-ROIC Companies

Quality Equities recently asked how to value a company like Costco that consistently looks expensive.

COST Costco is a prime example of a company that consistently appears expensive. With a subscription-based business model, significant untapped pricing power, and an exceptionally loyal customer base, it defies traditional valuation metrics. How do you accurately value a company like Costco?

I have two suggestions beyond the standard DCF.

A justified P/E Ratio based on ROIC as developed by Epoch Investors.

A justified P/E ratio derived from adding a steady state P/E ratio and a value creation P/E ratio as described by Michael Mauboussin and Dan Callahan (p. 26)

Justified P/E Ratio from ROIC

Two companies in the same industry with different returns on invested capital (ROIC) should not trade at the same P/E ratio.

We have two companies, A & B, and both want to grow by 6%. But company A has an ROIC of 30% and company B has an ROIC of 10%.

Company A with an ROIC of 30% only needs to reinvest 20% of its profits to grow 6%. It can return the other 80% of its profits to shareholders.

Company B, with an ROIC of 10%, needs to reinvest 60% of its profits to grow 6%. This means only 40% of its profits can be returned to shareholders.

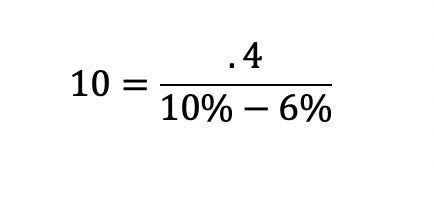

By tweaking the Gordon Growth Model, we can determine the justified multiple for each company.

Instead of D1 being the dividend, we’ll make it all the cash available to shareholders after its reinvestment need. Our required rate of return will be 10%.

For company A, the higher ROIC company that can distribute 80% of its profits to shareholders, we’re willing to pay a 20x multiple.

Company B, with its 10% ROIC, can only distribute 40% of its profits to shareholders. So, we’re only willing to pay 10x for Company B even though they are expected to grow at the same rate as company A.

Epoch Partners took this idea and then kept D1 and r constant to create a matrix of P/E multiples given a company's ROIC-WACC spread and expected growth rate.

WACC is 7.4%, but we’ll use 9.5% as the cost of capital as Epoch did which produces a spread of 15.5%.

Earnings estimates for the next 5 years range between 10-12%. To stay consistent with Epoch, I will use an 8% earnings growth.

Using Epoch’s matrix, Costco’s justified P/E ratio should be higher than 39.3x the highest value in the table provided.

I recreated the table on a spreadsheet to get to a 15.5% spread, and the justified P/E ratio is 45.33x

The key caveat is that we need to be confident in these earnings estimates and that Costco's future returns on invested capital and incremental invested capital returns will remain high.

Costco’s current P/E ratio is 62x.

Costco deserves a high P/E multiple given its ROIC, WACC, stable capital structure, and potential growth, but not 62x as determined by Epoch's method.

We can use another method championed by Michael Mauboussin and Dan Callahan to determine the right P/E ratio for a company like Costco.

Steady State P/E + Future Value Creation P/E

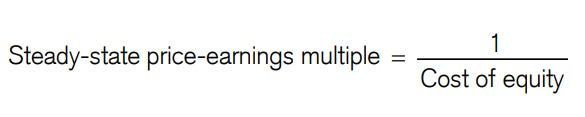

In their white paper What Does a Price Earnings Multiple Mean?, Mauboussin and Callahan break down the P/E ratio into two parts: Steady-State Value and Future Value Creation.

The Steady-State Value P/E ratio is 1 divided by the cost of capital.

Costco’s cost of equity is 7.4%. This gives us a Steady-State Value P/E ratio of 13.51x.

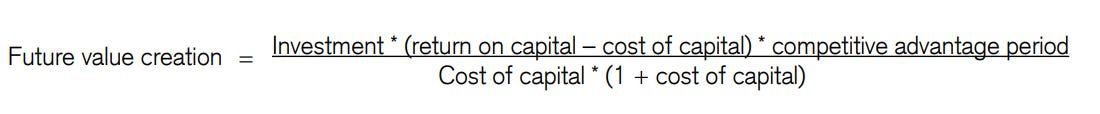

The formula for the Future Value Creation P/E ratio is the following.

To get the P/E ratio we need to make “Investment” equal to 1.

Return on Capital is 24.96%. The cost of capital is 7.4%.

I’m going to use 20 years for the Competitive Advantage Period.

Plugging all that in, I generate a Future Value Creation P/E ratio of 44.19x.

Then, we add the Steady State Value P/E to the Future Value Creation P/E.

13.51 + 44.19 = 57.70x

The key caveat here is that the competitive advantage period serves as the subjective variable. Extending this competitive advantage period leads to a higher justified P/E ratio. Conversely, shortening it results in a lower justified P/E ratio.

While this method yields a higher justified P/E ratio than the Epoch approach, it still falls short of Costco's current 62x multiple.

Justifying Costco's High P/E Ratio

Both the Epoch method and the Mauboussin-Callahan approach demonstrate why companies like Costco can command premium valuations compared to their peers.

Sustainable competitive advantages: Businesses with durable moats can maintain high returns on invested capital over extended periods, justifying premium valuations.

Capital allocation efficiency: Companies that generate high ROIC while requiring minimal reinvestment can return more cash to shareholders, warranting higher multiples.

Growth runway: Businesses with significant untapped market opportunities can sustain growth for longer periods, extending their competitive advantage period.

Pricing power: Companies with significant untapped pricing power have additional levers to drive future returns.

In Costco's case, its membership-based model creates sticky customer relationships, its operational efficiency yields industry-leading returns on capital, and its global expansion opportunities remain substantial. The company's demonstrated ability to raise membership fees periodically with minimal churn represents significant untapped pricing power.

Both methodologies demonstrate why Costco deserves a premium multiple. The key question for investors isn't whether Costco deserves a high P/E ratio—it does—but rather whether the current level accurately reflects its future value creation potential or has it moved into speculative territory.

At first glance, Costco appears overvalued with a P/E ratio well above both justified P/E ratios. However, remember: "The P/E ratio is not a measure of value; it is the consequence of the variables that determine value." One of those important variables is ROIC—and Costco's continues to grow.

Costco’s ROIC continues to grow because it has a long reinvestment runway and high reinvest opportunities, as illustrated by its high 3-year and 5-year Returns on Incremental Invested Capital (ROIIC).

A 62× multiple may indeed be justified for a company like Costco given its significant pricing power, growing ROIC, and extensive reinvestment runway.

Of course, the price we pay determines our return—the lower the multiple we pay, the higher returns we should expect from a high-quality company like Costco.

Gordon Growth Model is for infinity time period.

It is impractical to be applied in stock investment.

Super interesting frameworks, well explained. I have one company with ROIC above 70% and justifying the valuation is always a challenge. Definitely will try those approaches.