Stop Catching Falling Knives

Simple Rules to Help Avoid Large Losses

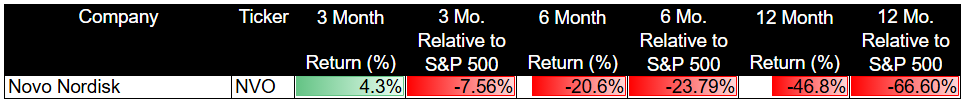

A big topic of discussion on the Value Investing Subreddit is whether Novo Nordisk (NVO) is an amazing value investment or a value trap.

If I had to lean one way or the other, I would say it is a great value at these prices.

But I'm aware that I could be incredibly wrong, or I could be so early in buying NVO that its continued price decline is indistinguishable from being wrong.

That's why I add a momentum check when buying a new position.

I define momentum as the traditional 3-month-1, 6-month-1, or 12-month-1 price movement. This means looking at a 3-month, 6-month, or 12-month return minus the most recent month, as short-term momentum tends to reverse.

You can use momentum in two ways:

Positive Screen

First, as a positive screen. You only buy a stock when it meets certain positive price momentum criteria. This prevents putting money into a stagnant position. You want to start earning returns, especially if the stock doesn't pay dividends.

The drawback, particularly for deep value investors, is that when momentum finally turns positive, much of the potential return from buying at the bottom is already gone. You're essentially paying more for improved market perception.

Negative Screen

Second, as a negative screen.

This helps avoid the worst performers. You refuse to invest in new positions showing the weakest price strength.

However, you still risk further price declines after periods of stabilization if the underlying business remains structurally flawed.

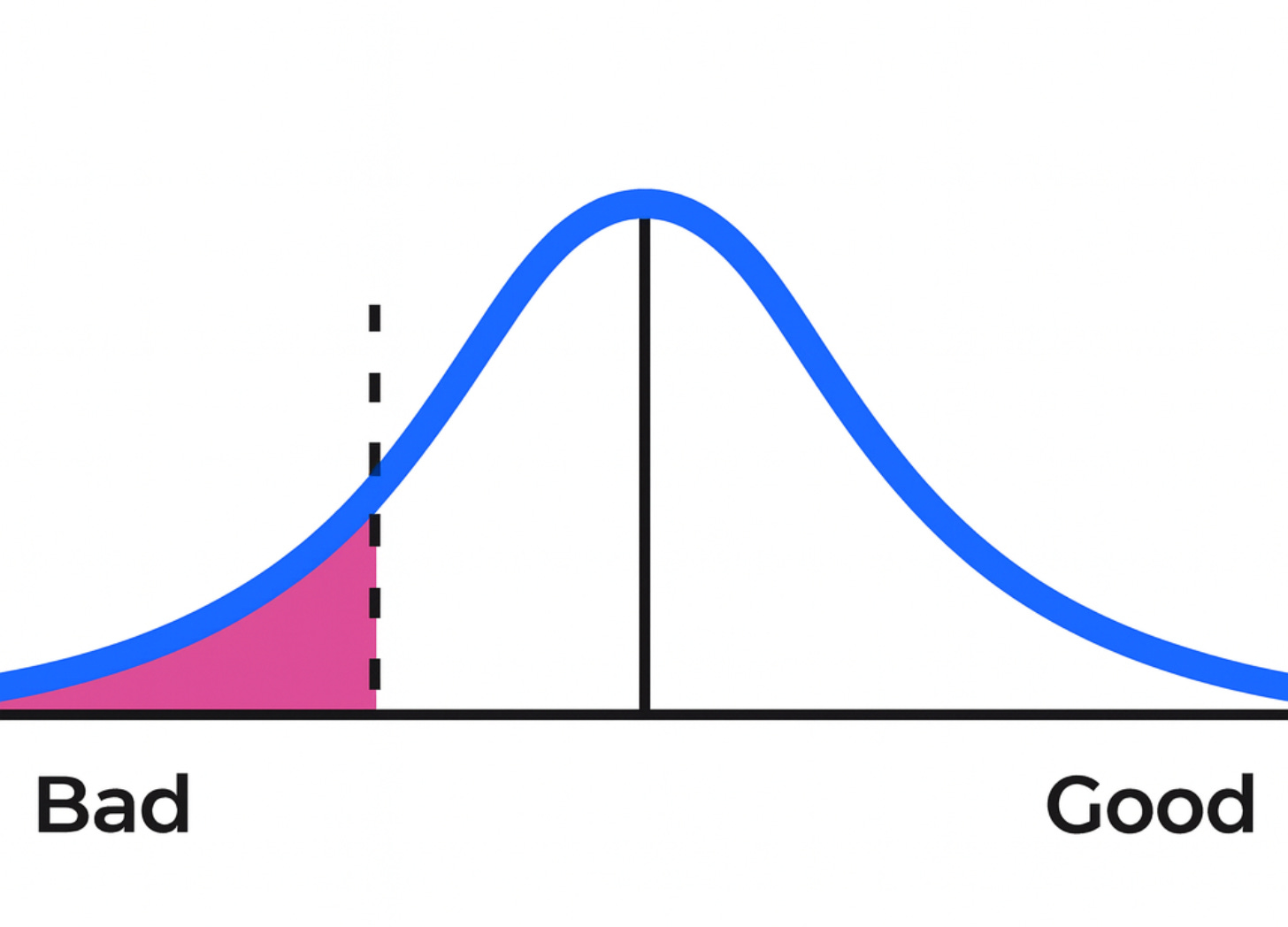

The goal with both approaches is to create a system that helps you avoid the left tail of stock selection. The truly bad investments.

By doing so, we’re hoping to incrementally improve our portfolio's overall returns.

Reduce Blind Spots

As investors, we tend to fall in love with stocks we're researching, especially when we believe they're cheap and the market is drastically undervaluing their future prospects.

But this creates tunnel vision and can blind us to other risks.

We need rules and systems to help pull us out of this tunnel vision and reduce our risk.

Momentum rules serve as one such tool. It functions as a kind of Wisdom of the Crowds tool. It helps us avoid risks we're unaware of but others may recognize.

Positive screens help us invest when other market participants begin recognizing the value we first recognized, but we have to be willing to sacrifice some early returns for this added comfort.

Negative screens help us avoid catching falling knives and prevent difficult post-investment decisions about stocks we thought were great values but continue declining. It also helps reduce the risk that we did poor research and valuation work. Maybe we were too optimistic with our base and worst-case assumptions? Or did we overestimate how impactful its upcoming growth catalysts would be? Again, it’s the Wisdom of the Crowds to help us account for what we don't know that others might.

Right now, Novo Nordisk fails both screens, positive and negative.

So even though I think it is most likely undervalued and not permanently impaired, I don’t know what I don’t know, so I use other rules to prevent myself from making a big mistake. And momentum is one of them.