The Invisible Monopoly in Every Commercial Jet

The Switching Costs That Lock in Decades of Profit

The market is starting to get expensive.

The S&P 500 currently trades at a 29x P/E ratio. Well above its historical median of 18x.

The Buffett Indicator (Market Cap to GDP) sits at 210% versus its 150% long-term average.

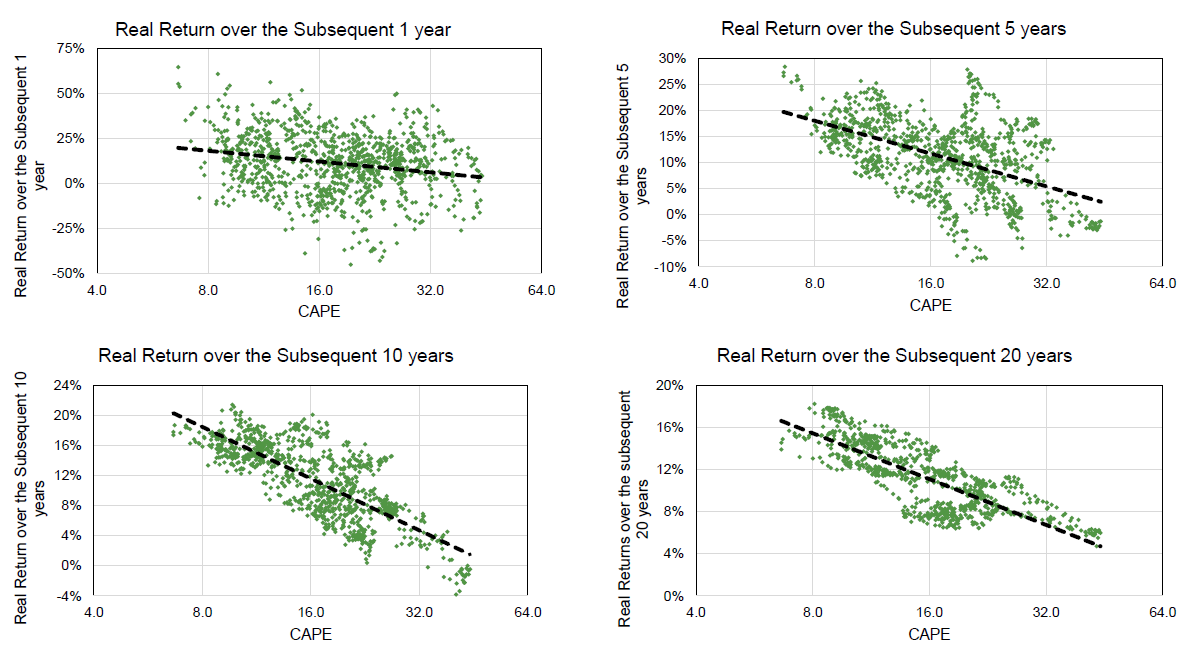

The Shiller CAPE ratio stands at approximately 40x, a level last seen during the dotcom bubble.

When valuations reach these heights, the math of future returns becomes considerably less favorable.

This doesn’t mean that the market is going to crash or that no stock can produce positive returns. It also doesn’t mean the market can’t get more expensive.

It simply suggests that the margin of safety across the broad market is thinner and the quality of individual businesses matters even more.

In this type of market, it pays to search for near-term catalysts that can unlock hidden value. Situations where the market has mispriced assets or failed to properly value distinct business units trapped within a larger corporate structure.

This is where corporate restructurings, particularly spin-offs, become attractive.

The Alpha in Spin-Offs

Joel Greenblatt’s classic You Can Be a Stock Market Genius introduced many investors to the great opportunity set within spin-offs.

Spin-offs continue to work because of several structural market flaws that persistently create opportunities.

Forced Selling

When large institutional investors receive shares of a spun-off entity that doesn’t fit their investment mandates, they become indiscriminate sellers. This selling pressure often occurs regardless of the underlying business fundamentals, creating temporary mispricings that astute investors can exploit.

Management Focus

Spin-offs create pure-play companies with focused management teams. Management compensation becomes directly tied to the performance of one business, aligning incentives with shareholders.

Conglomerate Discount

The conglomerate discount also disappears as the new entity can be properly valued in relation to its peers.

The GE Blueprint

General Electric’s recent corporate restructuring is a perfect example for how strategic spin-offs can unlock extraordinary shareholder value.

GE announced in November 2021 its plan to split into three focused companies: GE Healthcare (GEHC), GE Veronva (GEV), and GE Aerospace (GE).

Since its spinoff, GE HealthCare has appreciated 31%. GE Vernova is up over 400% since its initial public offering in April 2024. And GE Aerospace is up over 123% since the split with GE Vernova.

The GE story demonstrates how spin-offs can simultaneously unlock value in both the separated entity and the parent company by allowing each business to pursue its optimal strategy without the constraints and compromises inherent in a conglomerate structure.

Copying GE’s Playbook

Now another storied industrial conglomerate is executing a similar playbook.

This 100+ year-old diversified industrial powerhouse is in the process of splitting into three independent public companies.

The crown jewel of this separation is the aerospace division that stands to benefit from the same powerful tailwinds that have driven GE Aerospace’s remarkable performance: the global recovery in commercial aviation, a massive installed base requiring decades of high-margin aftermarket services, and structural competitive advantages in mission-critical technologies.

Once separated, it will emerge as a pure-play aerospace leader that can be properly valued against sector peers, with management wholly focused on capitalizing on the multi-decade aerospace upcycle.

That company is...

Keep reading with a 7-day free trial

Subscribe to Incremental Returns to keep reading this post and get 7 days of free access to the full post archives.