12 Lessons from The Power Law for Successful Investing

The Power Law is a book about Venture Capital investing but that doesn't mean it doesn't hold lessons for public market investing. These are 12 investing lessons I found in the book.

Lesson 1: Size Your Positions Correctly

Venture investing exemplifies the Pareto Principle—the vast majority of investment returns come from just a small fraction of the portfolio.

Khosla routinely put capital behind moon shots with a nine-in-ten chance of failure. But the low probability of a moon landing had to be balanced by the prospect of a large payout: if the company thrived, Khosla wanted to reap more than ten times his investment—preferably, much more than that.

Y Combinator, which backs fledgling tech startups, calculated in 2012 that three-quarters of its gains came from just 2 of the 280 outfits it had bet on.

“Venture capital is not even a home-run business,” Bill Gurley of Benchmark Capital once remarked. “It’s a grand-slam business.”

Success depends on understanding the risk-reward ratio of each investment and sizing positions accordingly. Taking risky bets is acceptable when properly sized. With the right position sizing, an investor can afford to lose small amounts on many investments while still achieving above-average returns if a few positions become major winners.

Lesson 2: Average Your Winners

the new venture capitalists came up with a second innovation: rather than organizing one large fundraising, they doled out capital in tranches, with each cautious infusion calibrated to support the company until it reached an agreed milestone.

This reminds me of the image of a young Paul Tudor Jones with the quote over his desk, “Losers average losers.”

VCs learned to invest additional capital in companies that hit key business milestones as their risk of failure decreased. They avoided putting more money into struggling companies.

Public market investors, however, often make the mistake of doubling down on losing investments. Rather than accepting their mistake and cutting losses, they cling to the belief that they're right and the market is wrong—throwing good money after bad. In contrast, great investors cut their losses early, let their winners run, and sometimes add more capital to their successful positions.

An example from the book is Genentech.

But the virtue of stage-by-stage financing became increasingly obvious. As successive risks were eliminated, each financing round valued Genentech higher than the previous one, so the founders could raise larger sums while giving away less equity.

Genentech was eventually bought by Roche for $46 billion.

Lesson 3: Perkin’s law

Tandem offered a spectacular demonstration of what became known as Perkins’s law: “market risk is inversely proportional to technical risk,” because if you solve a truly difficult technical problem, you will face minimal competition.

Perkins's law essentially describes investing in companies with strong competitive advantages or moats. These advantages are the most effective way to keep competitors at bay and maintain high profit margins.

Let's look at Genentech again as an example from the book.

The first product that Genentech proposed to manufacture was insulin, for which there was a huge and growing market.

But precisely because the technical challenges were so formidable, the barriers to entry in this business would be high, and Genentech would be able to extract fat margins if it succeeded. It was another illustration of Perkins’s law.

Genentech was a major success for Kleiner Perkins because its breakthrough technology created significant barriers to entry for competitors.

Lesson 4: Cultivate Luck

Some of the best parts of The Power Law are its stories of fortunes gained and fortunes lost—with luck being the key difference between them.

A perfect example is the Englishman who wanted to buy Apple shares. When told that Apple had just completed its latest financing round and wasn't selling more shares, rather than giving up, he decided to make his own luck.

His strategy?

Camp out in their lobby day after day until someone agreed to sell him shares.

Montagu said he would wait. “I have my toothbrush, and I can just lie here,” he repeated, as though dental hygiene were the only conceivable reason not to bed down in someone’s office. At a quarter to seven that evening, Mike Scott appeared again. “Mr. Montagu, you are really a fortunate guy,” he said. Steve Wozniak had decided to buy a house. To raise the cash, he wanted to sell some of his own equity.

Researchers dug deeper into the role of luck in venture capital success.

In 2018, a working paper published by the National Bureau of Economic Research tested this logic directly on the venture industry.[4] Sure enough, the authors confirmed the existence of feedback effects. Early hits for venture firms boost the odds of later hits: each additional IPO among a VC firm’s first ten investments predicts a 1.6 percentage point higher IPO rate for subsequent investments. After testing various hypotheses, the authors conclude that success leads to success because of reputational effects. Thanks to one or two initial hits, a VC’s brand becomes strong enough to win access to attractive deals, particularly late-stage ones, where a startup is already doing well and the investment is less risky, according to the authors.

While luck itself can't be practiced, you can take steps to increase your chances of being lucky.

One effective approach is to eliminate poor decisions.

Think of investment decisions as a bell curve. Our goal is to eliminate the left tail—those poor decisions that can permanently damage our capital. By avoiding bad investments, we naturally increase our chances of making good ones. With some luck, these good decisions can transform into exceptional ones that deliver phenomenal returns.

Another way to attract luck is by building a strong network. In fact, the core story behind The Power Law and Silicon Valley's venture capital success revolves around the power of personal networks.

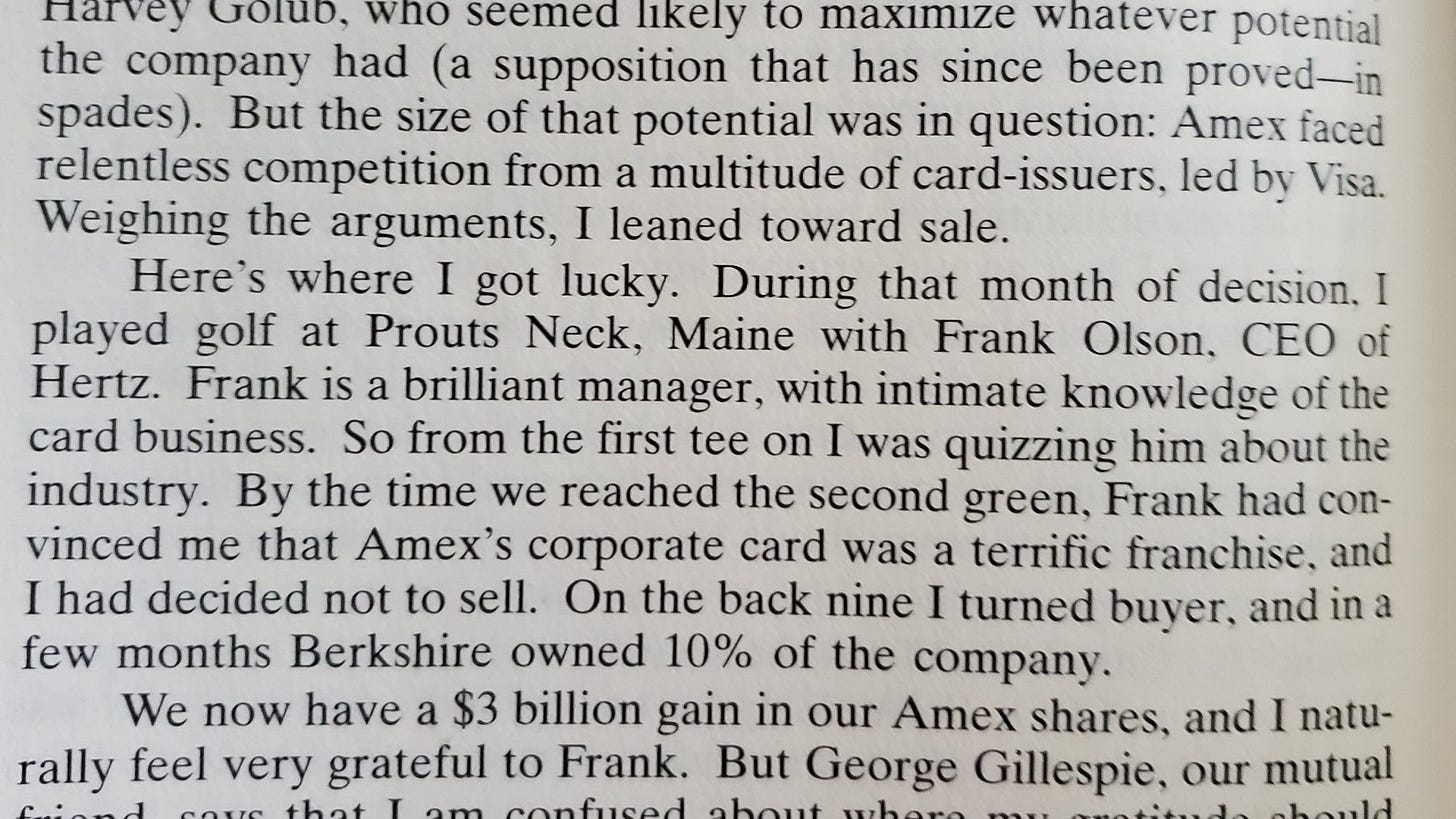

Warren Buffett exemplifies this perfectly. Though already a skilled investor, his access to great investments expanded alongside his growing network. From Insecurity Analysis.

“Buffett’s huge network of knowledgeable and influential friends also has been a help along the way. Buffett has been an original thinker, but it cannot have hurt to discuss prospects for a television station with Tom Murphy, chat about a common investment with Laurence Tisch, or talk with Jack Byrne about insurance. ‘His network of mends has been very important,’ says broker Hayes.” Of Permanent Value, The Story of Warren Buffett

Warren Buffett's investment in American Express following the salad oil scandal became a cornerstone of his investing legacy—but it nearly didn't happen. Thanks to his network's encouragement, he not only held his initial position but increased it substantially. What could have been a modest success transformed into an extraordinary return, launching Buffett into investment stardom.

Lesson 5: Metcalfe's Law

The utility of a personal computer would rise exponentially when it was hooked up to a network, they both agreed. Indeed, this insight came to be known as Metcalfe’s law: the value of a network rises with the square of the number of devices connected to it.

Companies with strong network effects, like Visa and Mastercard, can generate exceptional returns.

Later in the book, we meet Bill Gurley, who deeply understood the power of Metcalfe's law and network effects.

Before joining Benchmark, he [Bill Gurley] had been struck by the writings of Brian Arthur, a Stanford professor who studied network businesses. Companies that enjoyed network effects inverted a basic microeconomic law: rather than facing diminishing marginal returns, they faced increasing ones.

In network businesses, contrariwise, the consumer experience improved as the network expanded, so producers could charge extra for their products. Moreover, the improving consumer experience was matched by falling production costs because of the economies of scale in building a network.

Lesson 6: Don’t be Penny-wise but Pound-foolish.

everybody around the table remembered another one of Tom Perkins’s dictums: you succeed in venture capital by backing the right deals, not by haggling over valuations.

The best companies often look expensive at first glance. However, in 5-10 years, their market opportunities and competitive advantages can make today's seemingly high price look remarkably cheap. It's better to pay a fair price—or even a slight premium—for a great business than to miss out on a potential multi-bagger.

Lesson 7: Leave when Masayoshi Son Arrives

Son’s bid implied that Yahoo’s value had shot up eight times since his investment four months earlier. But the astonishing thing about his offer was the size of his proposed check: Silicon Valley had never seen a venture stake of such proportions.

Leveraging his new reputation as a digital Midas, he followed the Yahoo bonanza with a dizzying investment blitz, barely pausing to sort gems from rubbish. To borrow the language of hedge funds, he didn’t care about alpha—the reward a skilled investor earns by selecting the right stock. He cared only about beta—the profits to be had by just being in the market.

Besides, so long as the bull market continued, Son would earn more money than the venture old guard simply by deploying capital faster. He could spray capital at the unicorns without worrying about his aim. It was the old script all over again, except now he had a fatter hose to play with.

When Son starts wielding his checkbook, it's time to sell. He has marked the peak of the capital cycle twice in his life. When too much capital chases too few deals, prices get pushed to extremes. Remember: no matter how excellent a business may be, paying too high a price makes for a poor investment.

Lesson 8: Let Your Winners Run

In the case of Apple, for example, Valentine had sold out before the IPO, realizing a quick profit but depriving his limited partners of the bounty from Apple’s flotation. Moritz, in contrast, was a child of the postwar boom and had experienced little but success in his own life:

By winning this argument and cementing his authority within the firm, Moritz saw to it that the last distribution of Yahoo was put off until November 1999, when the company was trading at $182 per share, fully fourteen times more than the price at the flotation.

Building on lesson 1, most of your returns will come from just a few positions. When you have a winner, step back and let the company compound your returns. Follow the approach of the Connoisseurs from The Art of Execution.

It takes a lot of nerve to do nothing or merely trim a position when winning. Everything points to us being hard-wired to sell out of an investment when we have made a reasonable profit...

Their strategy was therefore to take a small bite and leave some for later, extending and maximising the pleasure of success as long as possible.

Taking small profits along the journey like a Connoisseur allows us to get instant gratification without ruining our long-term wealth aspirations. This ‘trick’ is one that I have seen in action and which allowed my best investors to stay in absolutely phenomenal winners.

Lesson 9: Stay Within Your Circle of Competence

Startups working on wind power, biofuels, or solar panels were capital intensive, heightening the risk of losing large sums; their projects took years to mature, depressing annual returns on the few that succeeded.

Astonishingly, the firm that had minted money during the first internet wave, preaching the power of Moore’s law and Metcalfe’s law, rushed into a sector that lacked these magical advantages.

Understanding your strengths and limitations is crucial—this is what Buffett calls the circle of competence. While capital-intensive businesses can be excellent investments, particularly when their high capital requirements create strong barriers to entry (like railroads), they require a different investment approach than software and technology companies. Kleiner-Perkins discovered this distinction the hard way.

Lesson 10: Does a Company Have Operating Leverage?

Rather than looking at profit margins—that is, the share of revenues remaining after costs are deducted—he looked at incremental margins, meaning the share of revenue growth that falls to the bottom line as profits.

As revenues grew, costs grew much less, so most of the additional income showed up as profits. It followed that growth would soon drive the three portals into the black.

Operating leverage can transform an unprofitable emerging company into a profitable one—or spell doom for those without it. Pandora and Spotify lack operating leverage in music streaming because their music licensing costs increase directly with user listening time. This explains Pandora's failure and why Spotify is aggressively expanding into podcasts, which do offer operating leverage.

Lesson 11: No Bonus Points for Degree of Difficulty

Unlike venture capitalists, Tiger was not looking to bet on original ideas. To the contrary, it liked companies that implemented a proven business model in a particular market. The goal was to invest in the eBay of South Korea or the Expedia of China. “The this of the that,” Coleman and Shleifer called it.

If a business model is a huge success in one market, why not find a similar company in an underfollowed market? There's no need to reinvent the wheel or complicate your search. Remember—you don't earn extra points for originality. Success comes from making smart investments, and it's perfectly fine to adopt someone else's winning investment idea.

Lesson 12: Systems to Reduce Bias

At Sequoia, the partners sometimes missed attractive Series B deals because they wanted to make themselves feel good. They hated to admit they had been wrong in saying no to the same startup at the Series A stage.

Ahead of a decision, each of them would read the investment memo with an unpolluted mind; they should do their utmost to avoid groupthink. Then they would come to the Monday meeting prepared to take a stand.

While we can't eliminate our behavioral biases, we can create systems to minimize their impact. Sequoia developed a process to counter their ego-driven decisions, recognizing they had passed on promising investments simply because they couldn't admit previous mistakes. Making an error is acceptable—but allowing that error to snowball into bigger mistakes is inexcusable.

Merely being aware of cognitive biases isn't enough to overcome them. We need concrete systems and automated processes to counteract their influence. What guardrails can you put in place to prevent your biases from derailing good investment opportunities?

If you read the book, what lessons did you pick up?

Understanding the Power Law in investing is crucial—outsized returns often come from a small number of high-impact investments, making conviction and patience essential